Form 941 Generator: Create Fillable Form 941 for 2024

What is Form 941?

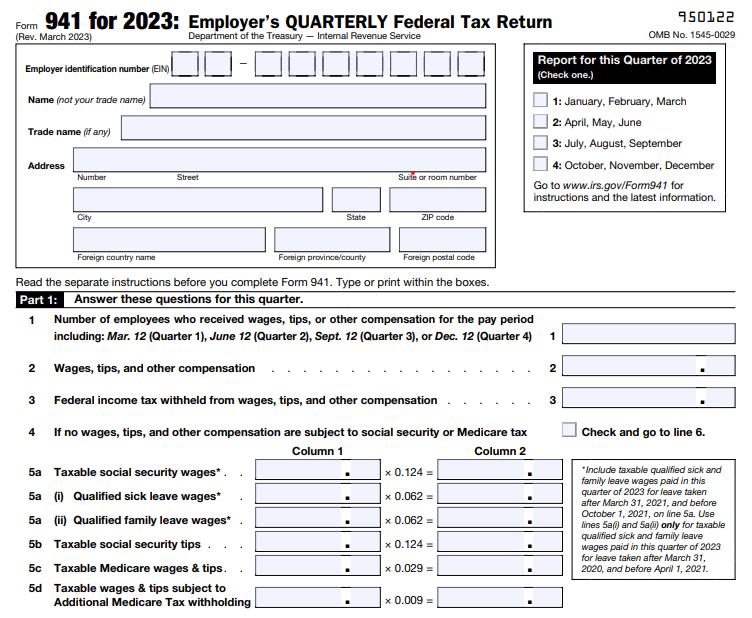

Form 941 is an important Quarterly Payroll Tax Form that has to be filed by each employer to report their withholding amount from each employee paycheck along with the employer’s portion for the respective quarter. Reporting of withholding taxes includes the total amount of federal income tax,

social security tax, and Medicare tax.

What is Form 941 Worksheet and why

should you complete it?

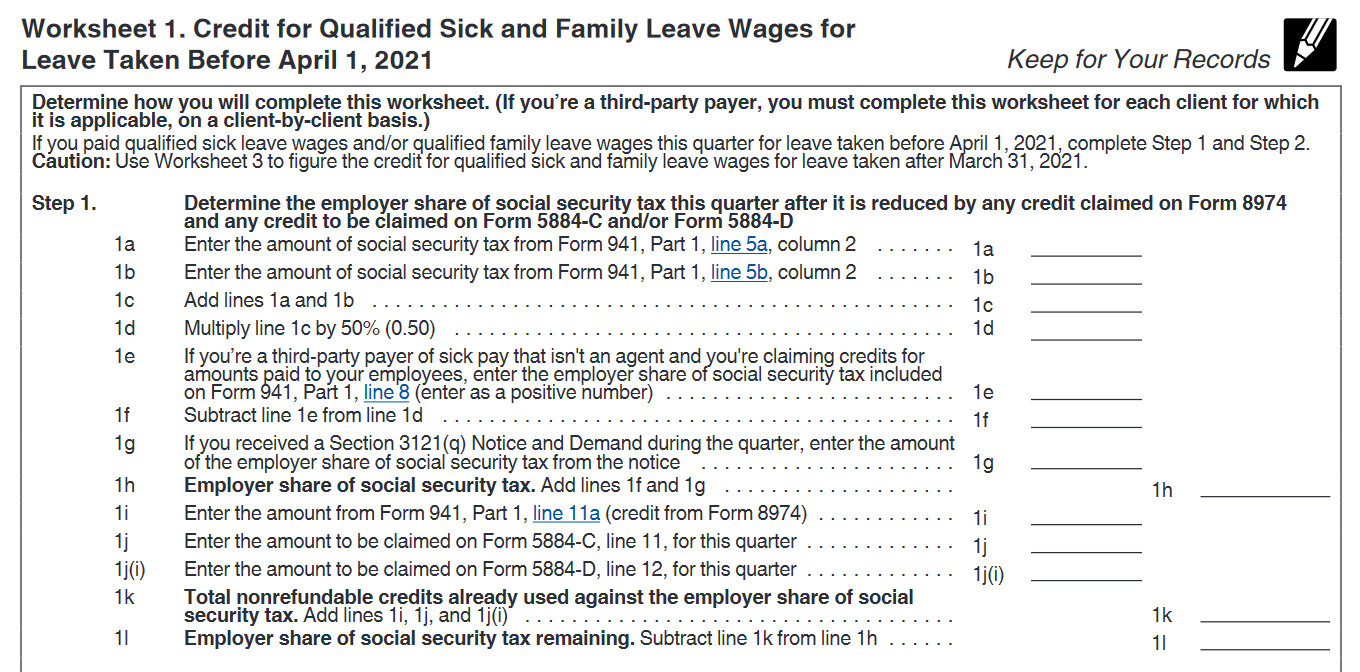

Form 941 Worksheet is used to calculate the qualified sick and family leave wages and employee retention credit.

IRS revised the Form 941 Worksheet 1 for the 2nd quarter of 2021. According to this, the Step 3 in the Worksheet 1 is made into a separate Tax Form 941 Worksheet 2 for 2nd quarter 2021 for calculating the employee retention credit on wages paid after March 31, 2021 and before July 1, 2021. Form 941 Worksheet 4 is for calculating employee retention credit for the third and fourth quarter. Other than these, Worksheet 3 and Worksheet 5 are added for the remaining quarters of 2021.

Visit https://www.taxbandits.com/form-941/941-worksheet/ to learn more.

Form 941 Due Dates For 2024

Form 941 is due by the end of the month after each quarter ends. The following are the

due dates of 941.

First Quarter

January to

March

the due date will be on

April 30th, 2024

Second Quarter

April to

June

the due date will be on

July 31st, 2024

Third Quarter

July to

September

the due date will be on

October 31st, 2024

Fourth Quarter

October to December

the due date will be on

January 31st, 2025

Be prepared to file your Forms before these deadlines.

Either you file your returns by paper or electronically. We provide a solution for both the filing methods.

Yes. You can create Fillable Form 941 for free to print and mail it with the IRS on your own, or you can E-File Form 941 directly to the IRS

through our software.

Why Choose Form941Generator.com?

Easy to Generate Forms

Fill & Generate IRS Form 941 for free with Form 941

Schedule B and Form 8974 if required

Create Unlimited Forms

Tax Professionals handling filing for huge clients can generate an unlimited number of Forms

Editable at anytime

You can always edit your forms generated before it

gets e-filed

Access Form Copies any time

Just login to your account to access or download your Form copies anytime & anywhere

Simplified E-filing

E-file your Generated Tax Form 941 to IRS with just a few clicks for a nominal fee

Keep your Forms Organized

A dashboard to keep track of all your Forms (941 Schedule B, 8974) including year-end Form W2 under one account

Simplify your 941 filing with these features and stay IRS Compliant.

How to Generate Form 941 Online?

Form941Generator.com is one of the best and free tools available in the market to help employers and the other tax professionals to

create fillable Form 941 Online.

Use our e-filing solution to electronically file your Generated Form 941 in minutes with IRS for just $5.95/form.

It takes only a few minutes, Avoid waiting for days!

“Choose to file your 941 form electronically and get IRS acceptance notification

on the same day.“

Electronic filing of Form 941 requires either an online signature PIN or Form 8453-EMP. If you don’t possess online signature PIN, never worry about it. You can still use Form 8453-EMP to Sign and authorize your 2023 Form 941 to file it electronically.

What is the Penalty for Not

Filing 941?

Below are the penalties, If you fail to file your Form 941 by the deadline:

Your business will incur a penalty of 5% of the total tax amount due. You will continue to be charged an additional 5% each month the return is not submitted to the IRS up to 5 months.In addition to failing to file, if you did not pay your owed tax bill you will initially be charged .5% of the unpaid tax amount, and this fee will increase each month the payment remains unpaid. The penalty will increase to 1% ten days following the IRS notice of intent to levy.

Visit https://www.taxbandits.com/payroll-forms/form-941-penalty/ to know more about the 941 late filing penalty

TaxBandits IRS E-file API Integration allows you to extend your software

The TaxBandits API is built with the RESTful architecture. To post any data requests, our API uses HTTP requests. All queries, response bodies, and error codes are encoded in JSON by this API.

You will be given access to a private sandbox testing environment where you will be able to test the application using real-world data. The API checks each request received and offers additional API access using authentication keys. You will receive 500 free credits for each tax form on your TaxBandits Sandbox account to begin testing your API account.

Seamlessly Integrate TaxBandits 1099 API to electronically file your 1099 return with IRS/SSA.

What is the Mailing Address of

Form 941?

The IRS requires every 941 filer to send the copy to them in case of paper filing.

Form 941 mailing address depends on the state your business is in and whether you include a

payment with Form 941.

Visit https://www.taxbandits.com/form-941/941-mailing-address/ to know the

941 mailing address for each state.

Complete and E-File Form 941

for 2024

Simple, Quick & Easy. It takes only less than

5 minutes.